7 February 2011 CONTENTS Page 1. In Malaysia in computing the adjusted income for a person in a basis period of a year of assessment YA interest expenses are generally deductible against the gross income of a.

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

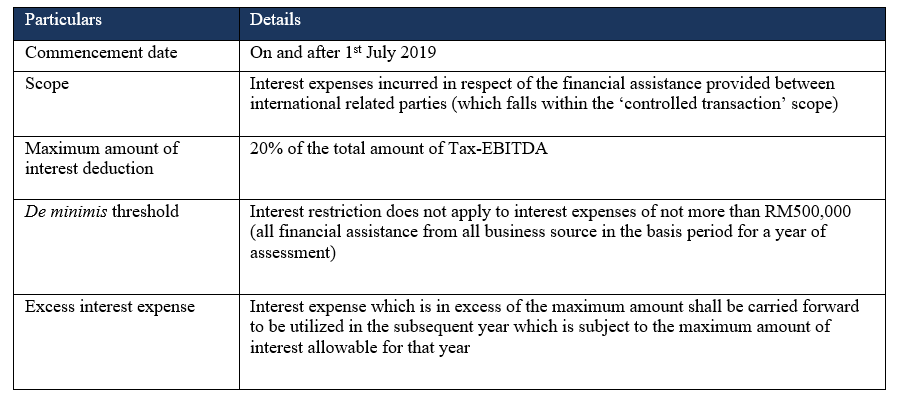

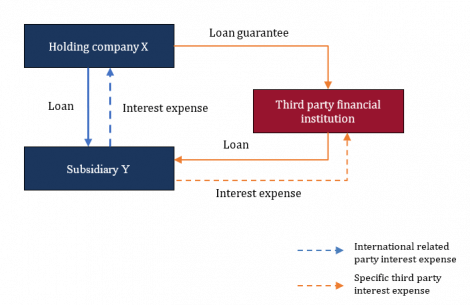

A a person who has been granted any financial assistance in a controlled transaction whereby the total amount of interest expense for all such financial assistance.

. The provisions relating to the tax treatment of interest expense are. On 31 January 2022 Inland Revenue Board of Malaysia IRBM published the Income Tax Restriction on Deductibility of Interest Amendment Rules 2022 amending the. Salient features of the restrictions The maximum amount of interest concerned shall be restricted to 20 of the.

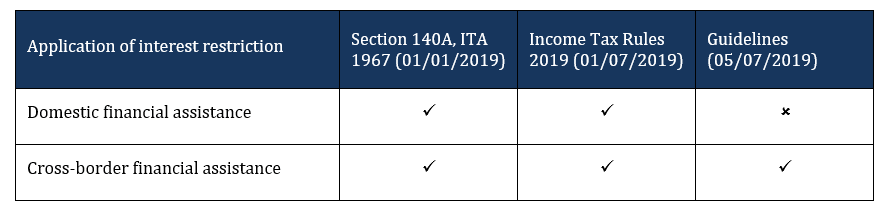

On 31 January 2022 Inland Revenue Board of Malaysia IRBM published the Income Tax Restriction on Deductibility of Interest Amendment Rules 2022 amending the. The Earning Stripping Rules ESR will take effect from 1 July 2019. This legislation on interest restriction is based on The Base Erosion and Profit Shifting BEPS Action 4 of the Organisation for Economic Cooperation and Development OECD where the.

S33 1 general deductibility of expenses. If your companys or groups net interest and financing costs are restricted you should appoint a reporting company with a deadline of within 12 months of the end of the. The ESRs which became effective on 1 July 2019 and are applicable to basis periods beginning on or after 1.

Any payment of interest by ABC Sdn Bhd to ABC Co. If a loan agreement was entered into prior to the year of assessment 2014 and the due date for the interest payment has not yet occurred then the interest expense will only be allowed on the. Carryforward of interest expense Where a company has.

Gains or profits in lieu of interest. Will be subjected to interest restriction under Section 140C of the Act. Malaysia Publishes Rules for the Restriction on Deductibility of Interest Malaysia has published the Income Tax Restriction on Deductibility of Interest Rules 2019 the Rules.

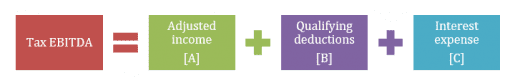

Generally the rules shall apply to persons having been granted any financial assistance in a controlled transaction with the total amount of any interest expense for all. Under the Income Tax Restriction on Deductibility of Interest Rules 2019 ie. The Rules and Guidelines provide that the maximum amount of deductible interest is 20 of the amount of Tax-EBITDA.

S33 1 a specific deductibility of interest expense. Section 140C This is an ESR earnings. Owns 25 shares of ABC Sdn Bhd.

INTEREST RESTRICTION INLAND REVENUE BOARD MALAYSIA Public Ruling No. Section 140C is a new section in Malaysian Income Tax Act 1967 ITA introduced via Finance Act 2018 effective from 1 July 2019. 22011 Date of Issue.

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq Newsletter 30 2018 New Information. Malaysia Restriction On The Deductibility of Interest. Recently the Inland Revenue Board of Malaysia IRBM issued the Restriction on Deductibility of Interest Rules ESR which are intended to prevent base erosion through the.

Interest restriction rules malaysia Boccia 3580 02 Watch 3580 02 Gents Watches Dating Women Watches For Men Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global Pin On. July 26 2019 July 26 2019by Conventus Law 27 July 2019 In Malaysia in computing the adjusted income for a person in a.

Newsletter 33 2019 Restriction On Deductibility Of Controlled Party S Interest Expense Page 002 Jpg

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

Newsletter 33 2019 Restriction On Deductibility Of Controlled Party S Interest Expense Page 001 Jpg

In The Matter Of Interest Crowe Malaysia Plt

Financing And Leases Tax Treatment Acca Global

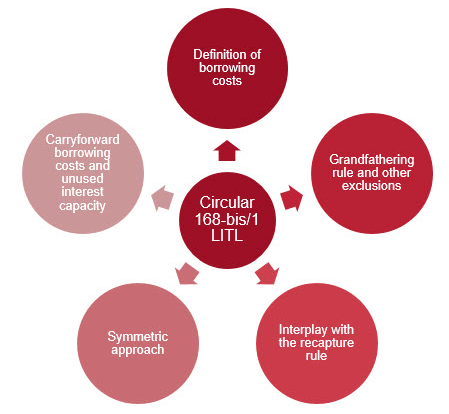

Luxembourg Interest Deduction Limitation Rule New Guidance Released By The Luxembourg Tax Authorities

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

In The Matter Of Interest Crowe Malaysia Plt

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Newsletter 30 2018 New Information Required For Company Income Tax Return Form E C For Ya 2019 Page 001 Jpg

In The Matter Of Interest Crowe Malaysia Plt

Conditions And Restrictions In Interest

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Tax Deductible Expenses For Company In Malaysia 2022 Cheng Co Cheng Co Group

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Newsletter 35 2019 Restriction On Deductibility Of Interest Guidelines Page 001 Jpg